Rubrik (RBRK)·Q4 2026 Earnings Summary

Rubrik Beats, Turns Profitable for First Time Since IPO

February 4, 2026 · by Fintool AI Agent

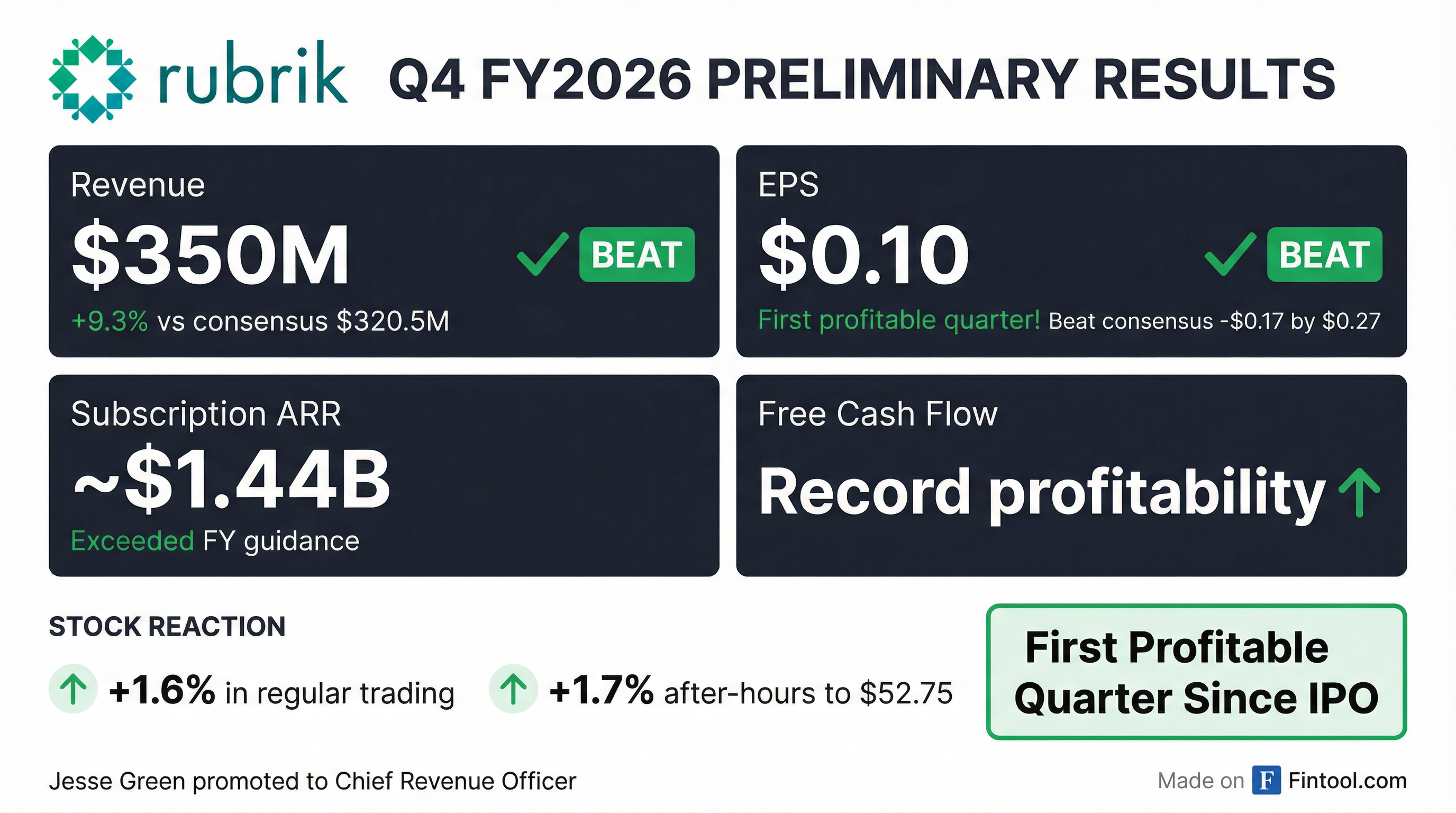

Rubrik (NYSE: RBRK) released preliminary Q4 FY2026 results today, announcing that all guided metrics were exceeded and promoting Jesse Green to Chief Revenue Officer. The cybersecurity and data protection company achieved its first profitable quarter since its April 2024 IPO, continuing an unbroken streak of beat-and-raise quarters.

Did Rubrik Beat Earnings?

Yes — decisively. Rubrik beat both revenue and EPS consensus, extending its perfect post-IPO earnings record to seven consecutive quarters.

*Values retrieved from S&P Global

This is the first time Rubrik has reported positive EPS and positive EBITDA — a major milestone for a company that was burning significant cash just 18 months ago.

Seven Quarters of Beats

Since its IPO in April 2024, Rubrik has beaten revenue consensus every single quarter, with beats ranging from 4.5% to 10.7%. The consistency is remarkable for a high-growth software company navigating a competitive cybersecurity market.

The path to profitability has been equally impressive. EPS improved from -$1.58 in Q2 FY2025 to +$0.10 in Q4 FY2026 — a $1.68 improvement in just 7 quarters. The company consistently beat EPS estimates by $0.15-$0.31 each quarter.

What Did Management Guide?

This 8-K filing contains preliminary results — full financial details and FY2027 guidance will be provided when Rubrik reports complete results on March 12, 2026.

Q4 Guidance vs. Actual

*Values retrieved from S&P Global

FY2026 Full Year (Implied)

Based on the Q3 guidance for full-year FY2026:

The 8-K explicitly states that "preliminary financial results exceeded all guidance metrics."

What Changed This Quarter?

1. First Profitable Quarter

The headline: Rubrik turned GAAP-positive for the first time since its April 2024 IPO. This was ahead of most analyst expectations, which had the company reaching profitability in FY2027.

2. Leadership Transition

Brian McCarthy, President of Global Sales and Field Operations, is resigning effective February 6, 2026, to pursue another opportunity.

Jesse Green has been promoted to Chief Revenue Officer to lead global revenue. Green previously served as President, Rubrik Americas, and has nearly 25 years of go-to-market experience at MongoDB, AppDynamics, and BMC Software.

CEO Bipul Sinha expressed confidence in the transition: "Under Jesse's leadership the team has realized exceptional growth and I am confident our momentum will continue as we grow and expand our business around the world."

3. Rubrik Agent Cloud in Beta

The company continues to develop its AI agent operations platform, Rubrik Agent Cloud (RAC), announced last quarter. This positions Rubrik at the intersection of cybersecurity and enterprise AI, targeting a market where organizations need to manage and govern AI agents at scale.

How Did the Stock React?

The stock reacted positively but muted given the magnitude of the beat. This may reflect:

- Leadership uncertainty — Sales leadership transitions can create execution risk

- Priced-in beat — Rubrik has beaten every quarter, so beats are expected

- Broader market weakness — The stock is down ~50% from its 52-week high

What to Watch: March 12, 2026

Full Q4 and FY2026 results will be reported on March 12, 2026. Key items to watch:

- FY2027 Guidance — Will management guide to continued profitability? Current consensus expects Q1 FY2027 EPS of -$0.11.*

- Subscription ARR Growth — Q3 ended at $1.35B growing 34% YoY. What's the FY2027 target?

- Identity Resilience Momentum — This new product line reached ~$20M ARR in just 3 quarters.

- Rubrik Agent Cloud Update — When will RAC exit beta and begin contributing revenue?

- Sales Leadership Transition — Any commentary on go-to-market disruption?

*Values retrieved from S&P Global

Forward Estimates

*Values retrieved from S&P Global

Analysts expect Rubrik to return to slight losses in Q1-Q2 FY2027 before resuming profitability in Q3-Q4 FY2027. This likely reflects planned investments in go-to-market for new products (Identity Resilience, Agent Cloud).

Key Context from Q3 Earnings Call

For context, here are highlights from the Q3 FY2026 earnings call (December 4, 2025):

Record Quarter Metrics :

- Subscription ARR: $1.35B (+34% YoY)

- Net New Subscription ARR: $94M (record)

- Cloud ARR: $1.17B (+53% YoY)

- Free Cash Flow: $77M (record)

- Net Retention Rate: >120%

Business Momentum :

- Legacy vendor replacements accelerated YoY

- Large customer deals ($1M+ ARR): +50% growth, 23 new customers added

- Identity business reached ~$20M ARR in 3 quarters

- 65 deals closed for new Identity Resilience product in first quarter of selling

Strategic Direction :

- Two product suites: Rubrik Security Cloud (cyber resilience) + Rubrik Agent Cloud (AI operations)

- Integrations announced with Microsoft Copilot Studio and Amazon Bedrock

- Recent acquisitions: Predibase (AI fine-tuning), Laminar (DSPM)